Who owns what in Big Media today

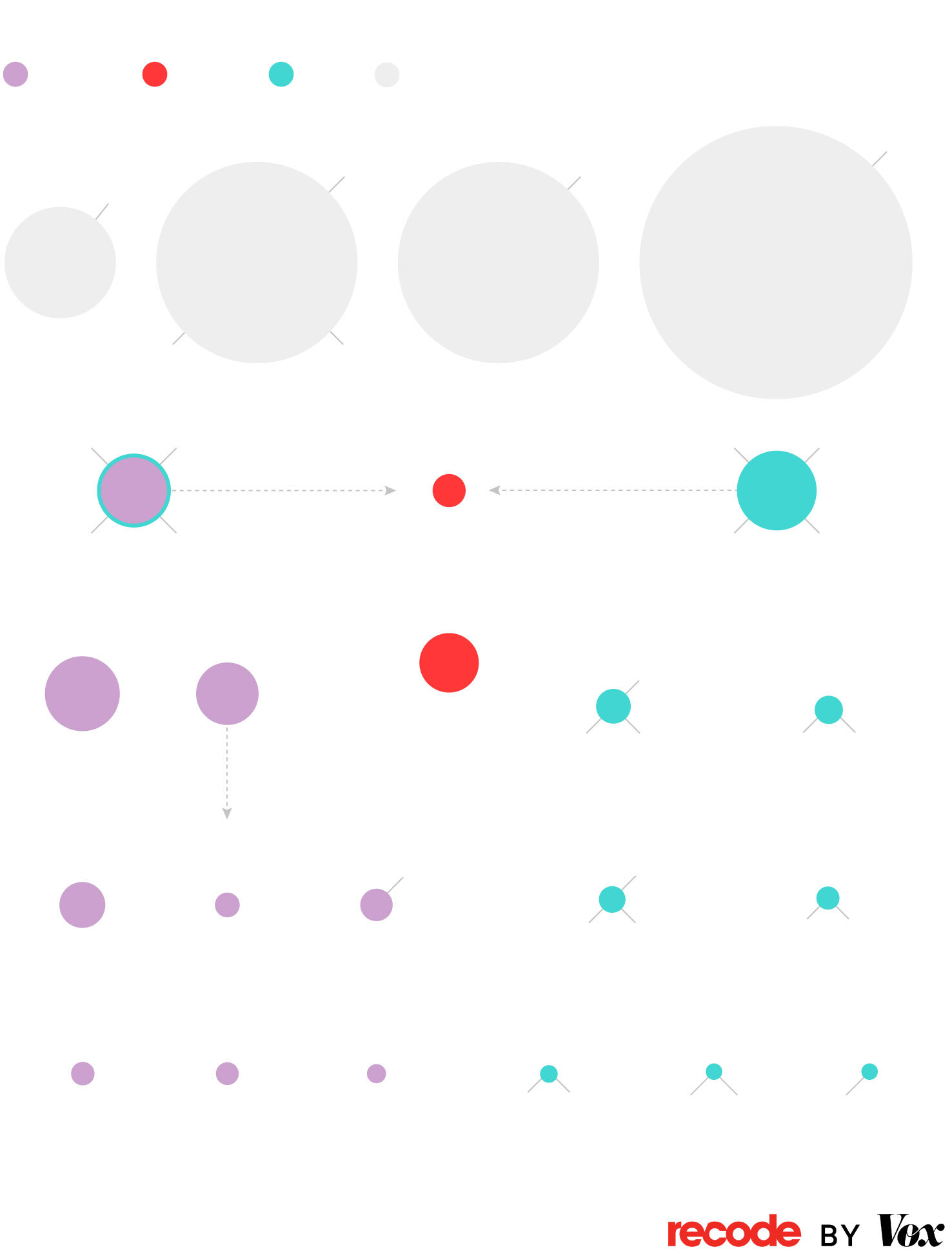

Amazon founder Jeff Bezos and Lauren Sanchez at the premiere of The Lord of the Rings: The Rings of Power in London, August 2022 | Niklas Halle’n/AFP via Getty Images How to track which media company owns your favorite show — and why that may no longer be a media company. In the very, very old days, TV was simple. There were three channels, you sat on your couch, and you watched whatever they showed you. That’s all different now, and much more complicated. Also more complicated: Figuring out which media or tech conglomerate owns the rights to the shows and movies you want to watch. We write about this stuff for a living, and we still get confused about it. Which is why we’ve produced the map below, which sketches out the relative size, power, and relationships between the companies that make, own, and distribute the stuff we watch at home, on our phones, and even sometimes in a theater. We’ve been making this one for four years. And each time we’ve created a new edition, we’ve promised that the map would continue changing, and it certainly has this time around. But it hasn’t changed in exactly the way we would have imagined just a few years ago. Yes, media companies continue to merge with and absorb each other. But the main change is that Wall Street, which used to love Netflix, is now much more ambivalent about streaming, so Netflix’s value has dropped dramatically. And every media company that has been chasing Netflix by trying to create its own high-growth, low/no-profit streaming service has seen its value fall as well. In 2016, for example, Time Warner was worth $85 billion plus debt to AT&T; now the company that used to be called Time Warner has been handed over to the Discovery cable networks, which has a combined value of only about $30 billion. The other major change is one we’ve made at the request of many of our readers, who rightfully argue that the giant tech platforms — Amazon, Apple, Facebook, and Google — are media companies. So we’re including them in this year’s edition, even though there are massive differences in the way those companies approach media. Amazon, for instance, treats media as a (very expensive) sidelight — a way to convince people to subscribe to its Prime shopping service. Meanwhile, YouTube is a key component of Google/Alphabet’s core advertising business. The main takeaway: These giants make the biggest media companies look tiny. (And yes, we should probably include TikTok next time.) Our warning/advice/promise still holds, by the way: There will be more changes to come on this map, chiefly via consolidation. It is now conventional industry wisdom, for instance, to believe that Warner Bros. Discovery will end up combining with Comcast’s NBCUniversal in the next couple of years. And smaller players like AMC Networks and Paramount are constantly described as acquisition targets. That said, it’s not entirely clear who would do the acquiring, given that any big tech acquisition of a major media outlet will draw lots of regulatory scrutiny. (It may be telling, for instance, that Amazon bought MGM — a media company that doesn’t own TV networks and has a low consumer profile. And the Biden administration still raised several eyebrows about that deal before letting it go through this year.) And combining two smaller media companies just gets you a … slightly bigger media company. So yes, this map will change ... somehow, sooner or later. We’re just done predicting how it’s going to change. Media landscape Distribution Streaming Content Tech Apple TV+ 20-40M subs Circles sized by market cap (September 2022) MGM YouTube Reels Facebook $392B Amazon $1.3T Google $1.3T Apple $2.4T Prime Video Channels Hulu $27.5B† NBC Peacock Disney+ ESPN 152M subs 13M subs Comcast $151B Disney $197B 67% stake 33% stake 46M subs 17M video 32M broadband CNBC Universal Studios Marvel Studios Lucasfilm Netflix $106B Verizon $173B AT&T $118B Warner Bros. Discovery $31B Turner (CNN, TNT, TBS) Fox $18B 221M subs Fox News Fox broadcast HBO, HBO Max, Discovery+ 92M subs Food Network 3.5M video 7M broadband 70% stake

How to track which media company owns your favorite show — and why that may no longer be a media company.

In the very, very old days, TV was simple. There were three channels, you sat on your couch, and you watched whatever they showed you.

That’s all different now, and much more complicated. Also more complicated: Figuring out which media or tech conglomerate owns the rights to the shows and movies you want to watch. We write about this stuff for a living, and we still get confused about it.

Which is why we’ve produced the map below, which sketches out the relative size, power, and relationships between the companies that make, own, and distribute the stuff we watch at home, on our phones, and even sometimes in a theater.

We’ve been making this one for four years. And each time we’ve created a new edition, we’ve promised that the map would continue changing, and it certainly has this time around.

But it hasn’t changed in exactly the way we would have imagined just a few years ago. Yes, media companies continue to merge with and absorb each other. But the main change is that Wall Street, which used to love Netflix, is now much more ambivalent about streaming, so Netflix’s value has dropped dramatically.

And every media company that has been chasing Netflix by trying to create its own high-growth, low/no-profit streaming service has seen its value fall as well. In 2016, for example, Time Warner was worth $85 billion plus debt to AT&T; now the company that used to be called Time Warner has been handed over to the Discovery cable networks, which has a combined value of only about $30 billion.

The other major change is one we’ve made at the request of many of our readers, who rightfully argue that the giant tech platforms — Amazon, Apple, Facebook, and Google — are media companies. So we’re including them in this year’s edition, even though there are massive differences in the way those companies approach media. Amazon, for instance, treats media as a (very expensive) sidelight — a way to convince people to subscribe to its Prime shopping service. Meanwhile, YouTube is a key component of Google/Alphabet’s core advertising business. The main takeaway: These giants make the biggest media companies look tiny. (And yes, we should probably include TikTok next time.)

Our warning/advice/promise still holds, by the way: There will be more changes to come on this map, chiefly via consolidation. It is now conventional industry wisdom, for instance, to believe that Warner Bros. Discovery will end up combining with Comcast’s NBCUniversal in the next couple of years. And smaller players like AMC Networks and Paramount are constantly described as acquisition targets.

That said, it’s not entirely clear who would do the acquiring, given that any big tech acquisition of a major media outlet will draw lots of regulatory scrutiny. (It may be telling, for instance, that Amazon bought MGM — a media company that doesn’t own TV networks and has a low consumer profile. And the Biden administration still raised several eyebrows about that deal before letting it go through this year.) And combining two smaller media companies just gets you a … slightly bigger media company.

So yes, this map will change ... somehow, sooner or later. We’re just done predicting how it’s going to change.

Media landscape

Distribution

Streaming

Content

Tech

Apple TV+

20-40M subs

Circles sized by market cap (September 2022)

MGM

YouTube

Reels

$392B

Amazon

$1.3T

$1.3T

Apple

$2.4T

Prime Video

Channels

Hulu

$27.5B†

NBC

Peacock

Disney+

ESPN

152M subs

13M subs

Comcast

$151B

Disney

$197B

67% stake

33% stake

46M subs

17M video

32M

broadband

CNBC

Universal

Studios

Marvel

Studios

Lucasfilm

Netflix

$106B

Verizon

$173B

AT&T

$118B

Warner Bros.

Discovery

$31B

Turner

(CNN,

TNT, TBS)

Fox

$18B

221M subs

Fox

News

Fox

broadcast

HBO, HBO Max,

Discovery+

92M subs

Food

Network

3.5M video

7M broadband

70% stake

Sony Pictures

$9.5B**

Paramount

$15B

Charter

$60B

DirecTV

$12B

Cox

$26B*

Axios

CBS

Columbia

Pictures

Sony

Pictures TV

Paramount+

43M subs

Showtime

15M video

30M broadband

14M video

3M video

5.5M broadband

Roku

$10B

Altice USA

$4B

Dish

$9B

AMC

$1B

Univision

$<1B

Lionsgate

$2.3B

60M active

accounts

10M video

(includes Sling)

2.5M video

4M broadband

IFC

Shudder

Univision News

Lionsgate

Films

Starz

†Minimum based on 2019 deal; *assumes 2X revenue multiple;

**assumes 1X revenue multiple

Source: The companies, news reports, Leichtman Research Group (cable/ internet subs),

Recode reporting

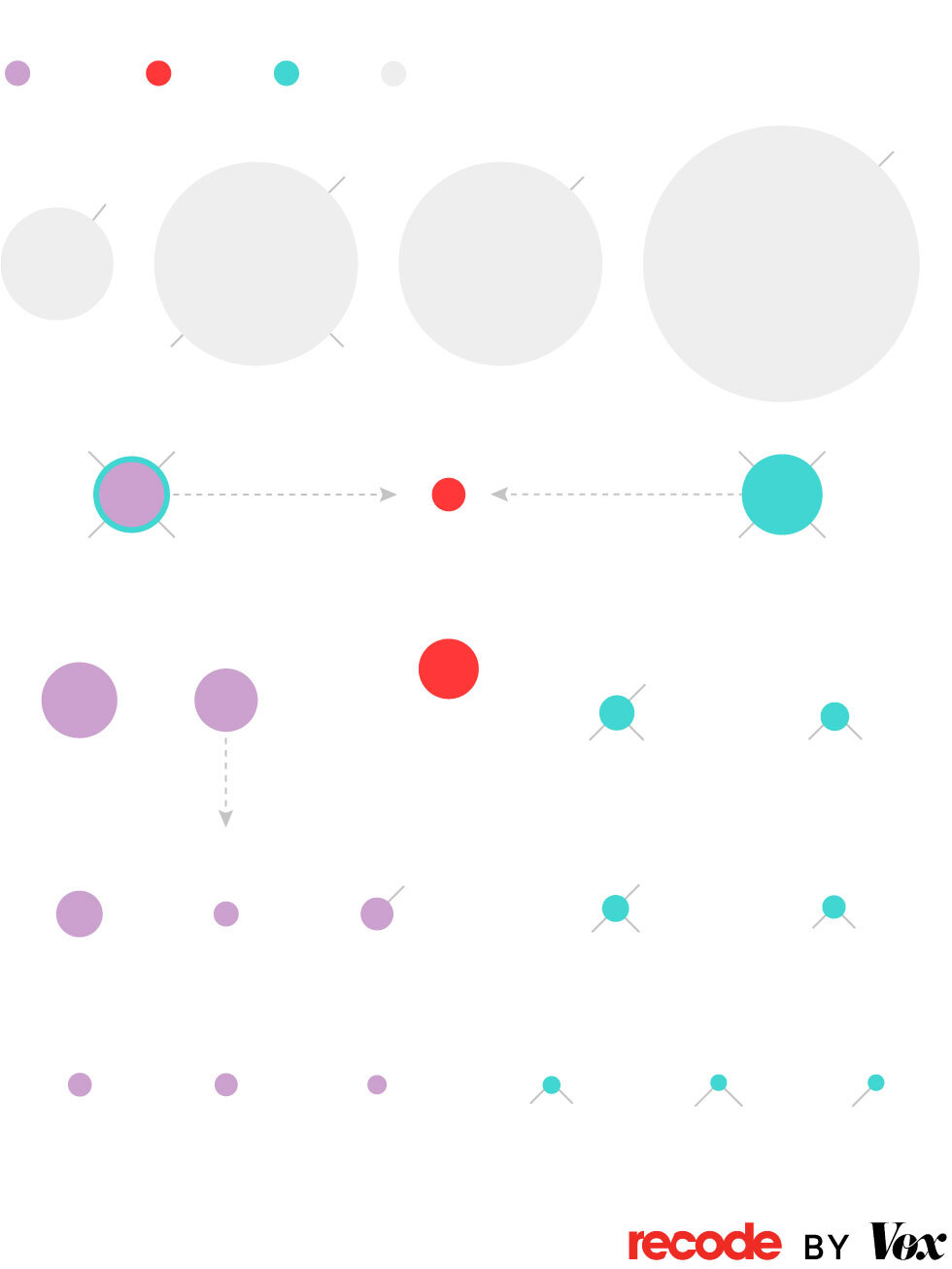

Media landscape

Distribution

Streaming

Content

Tech

Apple TV+

20-40M subs

Circles sized by market cap (September 2022)

MGM

YouTube

Reels

$392B

Amazon

$1.3T

$1.3T

Apple

$2.4T

Prime Video

Channels

Hulu

$27.5B†

Disney+

NBC

Peacock

ESPN

13M subs

152M subs

Comcast

$151B

Disney

$197B

33% stake

67% stake

46M subs

17M video

32M

broadband

Lucasfilm

CNBC

Universal

Studios

Marvel

Studios

Netflix

$106B

AT&T

$118B

Verizon

$173B

Warner Bros.

Discovery

$31B

Turner

(CNN,

TNT, TBS)

Fox

$18B

221M subs

Fox

News

Fox

broadcast

HBO, HBO Max,

Discovery+

92M subs

Food

Network

3.5M video

7M broadband

70% stake

Sony Pictures

$9.5B**

Paramount

$15B

Charter

$60B

DirecTV

$12B

Cox

$26B*

CBS

Axios

Columbia

Pictures

Sony

Pictures TV

Paramount+

43M subs

Showtime

14M video

15M video

30M broadband

3M video

5.5M broadband

Roku

$10B

Dish

$9B

Altice USA

$4B

AMC

$1B

Univision

$<1B

Lionsgate

$2.3B

60M active

accounts

10M video

(includes Sling)

2.5M video

4M broadband

Univision News

IFC

Shudder

Lionsgate

Films

Starz

†Minimum based on 2019 deal; *assumes 2X revenue multiple;

**assumes 1X revenue multiple

Source: The companies, news reports, Leichtman Research Group

(cable/ internet subs), Recode reporting

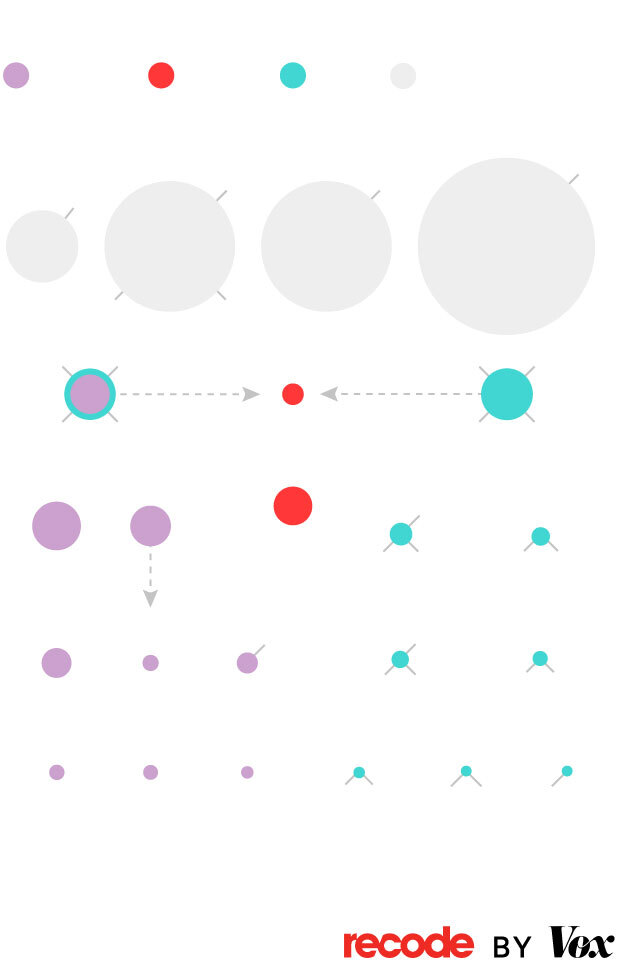

Media landscape

Distribution

Streaming

Content

Tech

Circles sized by market cap (September 2022)

Apple TV+

20-40M subs

MGM

YouTube

Reels

$392B

Amazon

$1.3T

$1.3T

Apple

$2.4T

Prime Video

Channels

Hulu

$27.5B†

Disney+

NBC

Peacock

ESPN

13M subs

152M subs

Comcast

$151B

Disney

$197B

33% stake

67% stake

46M subs

17M video

32M

broadband

CNBC

Universal

Studios

Marvel

Studios

Lucasfilm

Netflix

$106B

AT&T

$118B

Verizon

$173B

Warner Bros.

Discovery

$31B

Turner

(CNN,

TNT, TBS)

Fox

$18B

221M subs

Fox

News

Fox

broadcast

HBO, HBO Max,

Discovery+

92M subs

Food

Network

3.5M video

7M broadband

70% stake

Sony Pictures

$9.5B**

Paramount

$15B

Charter

$60B

DirecTV

$12B

Cox

$26B*

CBS

Axios

Columbia

Pictures

Sony

Pictures TV

Paramount+

43M subs

Showtime

14M video

15M video

30M broadband

3M video

5.5M broadband

Roku

$10B

Dish

$9B

Altice USA

$4B

AMC

$1B

Univision

$<1B

Lionsgate

$2.3B

60M active

accounts

10M video

(includes Sling)

2.5M video

4M broadband

Univision News

IFC

Shudder

Lionsgate

Films

Starz

†Minimum based on 2019 deal; *assumes 2X revenue multiple;

**assumes 1X revenue multiple

Source: The companies, news reports, Leichtman Research Group

(cable/ internet subs), Recode reporting

This article has been sourced from various publicly available news platforms around the world. All intellectual property rights remain with the original publishers and authors. Unshared News does not claim ownership of the content and provides it solely for informational and educational purposes voluntarily. If you are the rightful owner and believe this content has been used improperly, please contact us for prompt removal or correction.